Dear Reader,

This past Tuesday, Tesla announced an investment package totaling $3.6 billion to finance the construction of new Nevada factories for the production of 4680 battery cells as well as the much-teased, almost mythological Tesla Semi.

The news didn’t cause the trading volume spike that Tesla investors typically generate whenever the company makes major headlines, but, at the same time, share prices remained steady while the rest of the market continued to wade through the quagmire of uncertainty.

Since the start of the new year, Tesla stock has managed to hit multi-year lows and recover to the tune of over 40% as prices dipped dangerously close to $100 before bouncing back into the $140s.

The question all this begs is: Is the bloodletting over? Can the EV speculators and anxiety-stricken former fanboys venture back into the stock?

Well, some technical analysts may claim that the time has come, projecting 12-month targets of between $200 and $400 (roughly), so if you’re looking for a reason to buy back in, or double down, or quadruple down, then the excuse is there.

Is Wall Street Overlooking This Intentionally?

But you would also be ignoring a problem that none of these analysts seem to factor into their conclusions.

Tesla, while still by far the biggest (by market cap) automaker out there, let alone EV-only producer, is currently staring its fate directly in the eyes.

You see, at the heart of every Tesla lie its motors — usually two, but three for the Model S Plaid (one for each rear wheel and one for the front axle).

These motors are among the most advanced in the industry, and in their three-unit configuration they generate a total of more than 1,000 horsepower and 1,100 pound-feet of torque.

Now, here's the news…

All of these engines, as of this writing, are officially obsolete.

You read that correctly. The motors that drive today’s most advanced, most sought-after electric cars are obsolete tech.

Now, before you start to panic, let me clarify. This problem is not isolated to Tesla.

All current EV motors suffer from the same issue. In fact, all of today's electric motors, but for a few exceptions, share the same design defect.

Let me explain.

A Defect Hidden Deep Within the Design DNA

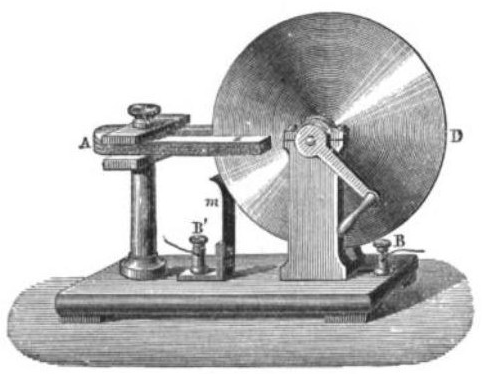

Since their advent in the 1820s, electric motors have followed one basic design blueprint. There’s a spool, there’s a copper coil wound around that spool, and there’s a magnetic field surrounding it all.

When electrical charge is introduced into that copper coil, rotational momentum is generated.

That was the way Michael Faraday first conceptualized the electric motor, and that’s the way they’ve been built ever since.

Today we make them smaller, we make them larger, we make them faster, stronger, and longer-lasting, but in essence, we make them the same as the very first prototypes.

There were shortcomings to the mechanism, of course, one of the most substantial ones being efficiency drop-off when outside of optimal operating speeds.

Put simply, every motor had a set speed at which it transferred watts to torque most efficiently. Running that motor slower or faster than the optimal speed led to less and less output.

This Is the Dreadnought of the Electric Motor World

It wasn’t a big deal when every electric motor in the world had the same limitations… But very recently, all of that changed.

A Canadian tech company came up with a way to dynamically manage electrical charge by delivering it in very precise dosages, to very specific parts of the coil using AI algorithms.

The result was a massively improved output curve, with more torque, more horsepower, and less resistance at all speeds.

The company behind all this recently teamed up with an electric motorcycle producer to create a street bike with 60% more power than the world’s current fastest production internal combustion engine superbike — the Suzuki GSX1300R Hayabusa — on a lighter, quicker frame. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

This company has similarly partnered with an electric boat maker, an electric high-speed rail company, and a handful of others to test the true potential of this technology.

The Holy Grail application, of course, is going to the EV.

In the next year or so, you are going to see a battle for this intellectual property waged by some of the biggest names in the electric car business.

I’m talking about Tesla, Toyota, VW, GE, and the rest of the big car brands.

The Next Big Buyout?

Their choice is going to be simple: License the technology, buy the company outright… or sit back and slowly sink into irrelevance.

There will be no turning back after this.

The only question is: Who will be the first to make a move, and at what price?

Now, here’s the really important part… this company is already public. Its market cap is just over USD$250 million.

That’s about half of 1/1,000th the market capitalization of Tesla, the company that I believe is best suited for — and most likely to try to get control of — this technology.

The benefits that such an acquisition will create, however, will be worth many tens of times more.

With the economy the way it is today, and particularly the tech sector taking the hits that it’s taken over the course of the last six months, this company’s stock, which trades on two North American exchanges, may never be this cheap again.

It’s at less than $2 as you read this.

Two years ago, at the top of the market, it was trading at three times that.

A Perfect Storm for Price Inefficiency

In another year or two, it may be at 10x where we are now, depending on how things play out macro-wise.

I know this is a lot of information to digest on such short notice, so I’m going to make it easy for you.

I recently published an informational video on this company, its tech, and where I think its valuation is headed in the near term and midterm.

It’s quick, easy to understand, and will save you weeks of due diligence.

I’m making it available to our Wealth Daily readers right here.

No registration required. Just click, view, and equip yourself with all the information you need to make an educated decision.

Just remember, today’s valuation is a product of a down market coupled with relatively little attention from the mainstream investment community.

But bear markets don’t stick around forever, and stories like this definitely don’t stay secret for long, which means your window to get in at prices like today’s is closing fast.

It costs nothing, besides a few minutes of your time, to get the full story.

Don’t put it off. Enter here for instant access.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.